LIVE AT 11:15 AM ET FRIDAY: A SUB-$20 STOCK WITH A $500K INSIDER BUY — AND WHY THIS IS BIG NEWS

Hey traders… Wow — what a wild ride in the markets!

The VIX spiked a blistering 75% Wednesday — a perfect example of why trading spreads has become my go-to strategy in this environment.

Yes, I said it… spreads! I know I’ve pooh-poohed spreads a bit in the past, but I think I’ve finally discovered a spread trading strategy that works for me.

And with volatility running high, the game has changed. Outright options are pricey right now — and you likely know that CHEAP options are my bread and butter — but spreads?

They’re hitting a sweet spot right now, offering great ROI while limiting costs.

Highlights from the video:

📈 Massive VIX Surge — A mysterious trader bet $5.1 million on VIX call spreads, aiming for a $300 million payout if the VIX crosses 60 by February.

🔥 Why Spreads Work Now — Elevated implied volatility makes debit spreads an excellent choice for both hedging and directional trades.

🚫 Illiquid Alternatives — Instruments like UVXY and VXX remain too illiquid for effective trading.

💡 Actionable Examples — Learn how to capitalize on juicy premiums in high-priced tickers like NVDA, SPY and AMD.

Let me know what you think and drop any ticker requests — I’ll break them down in the next video!

Order Flow:

As for order flow…

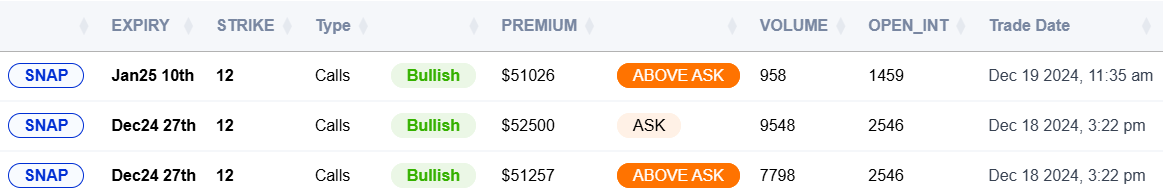

We’ve seen a flurry of Snapchat (SNAP) calls bought this week, likely in anticipation of a TikTok ban. We entered the next $11 and $12 calls during Wednesday’s Santamania live trading session.

They’re down today but we saw yet another buy today, this time in the Jan. 10 expiration $12 calls.

We’re seeing a lot of longer-dated flow today with traders likely still reeling a bit from Wednesday’s massive down move.

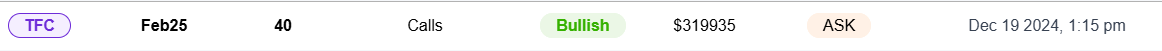

In addition to SNAP, we included an order in the Truist Financial (TFC) February $40 calls. This is a hefty order, about $320K, in a ticker you don’t see a lot. They’re also a couple of bucks in the money, so one could move to the $42.50 calls with shares trading at $42.71.

Banks are on deck to report earnings in January, so this could be a decent longer-term play, especially if the stock pulls back along with the market next week, which may put that $40 strike they bought closer to the money (and cheaper).

Slap it on your watchlist for now!

*This is for informational and educational purposes only. These are not official alerts issued by Lance, but rather some interesting orders picked by the team at Lance Ippolito Trading.

There is inherent risk in trading. Trade at your own risk.

Note: If no date is listed after the month, it’s the monthly expiration (third Friday).

The team at Lance Ippolito Trading

Lance doesn’t want the CCP spying on him, so you’ll never find him on TikTok. Same goes for other social media sites, which are filled with impersonators, scammers and crypto bros.

You can only find him on his personal YouTube Channel — smash that Subscribe button! https://www.youtube.com/@LanceIppolito

And in his private Telegram channel: https://t.me/+-gVwEIwGJhplMTgx

Important Note: No one from The TradingPub team or any of its associated brands will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. BREAKING NEWS: TSLA Hits All-Time Highs!

With Tesla showing up in headlines like this…

I won’t be surprised if it skyrockets higher – even though it has been up by over 100% in the last three months alone…

Now, if you currently own Tesla stock, that’s a pretty good return, but with a Tesla-oriented strategy, we’ve been able to target even more!

So far in 2024, we’ve gone 35-10, a winning percentage of 77.8%!

Obviously, not every trade will be a winner… but with how much Tesla has maintained its upward momentum for the past few months…

So, if you’d like to get the complete details on how I’m targeting the next trade, plus how you can do it right in your brokerage account…

All you need to do is check this Tesla briefing out…

The profits and performance shown are not typical, we make no future earnings claims and you may lose money. From 7/20/2023 – 12/16/24, on live issued trades, the win rate is 75.4.3% and the average return is 29.08% (including winners and losers) over a 4-day hold time.