>>GET MY PRE-ELECTION FORECAST<<<

SAVE THE DATE: 1 P.M. ET ON MONDAY, MAY 6!

One thing I’ve learned over the years is stocks tend to get volatile when they approach and break through a 52-week high/low price point.

The main reason for this volatility is because the one-year high and low is the center point for many traders, including professional hedge and mutual funds that put a lot of weight into the 52-week high/low price.

That’s why I want to teach you the 52-week pop strategy.

It’s one of the first techniques I teach people who want to learn how to trade stocks, futures and forex markets.

The 52-Week Pop Strategy: The Basis for the Setup

Back before everyone had access to the internet and traders were a little less sophisticated, the 52-week high/low point was known as a breakout point.

It was where markets broke out and continued moving in the same direction with continued momentum.

But as more traders caught onto the method to buy and sell near the 52-week high/low price, markets began demonstrating more and more false breakouts near this price level.

As a result the, 52-week high/low began losing credibility as having any type of edge that could benefit traders or increase their odds of winning.

A Different Way to Trade the 52-Week High/Low

After several years of monitoring how markets behave, professional traders realized they’d hit the 52-week high/low area, and then pull back once more before approaching the area again. Then they’d break out a second time with strong momentum…

To take advantage of this price action, I created a 52-week pop strategy that uses these price points without subjecting traders to drawdowns and pullbacks that occur near them.

Find Markets That Touch Their 52-Week Price High/Low Level

When using my 52-week pop strategy, you want to start by finding stocks, futures or forex markets that are touching the 52-week high/low price level.

You also want to find markets that aren’t edging slowly toward the 52-week level, but rather are gravitating toward it with increased volatility and momentum.

The more volatility and momentum it has near these levels, the better.

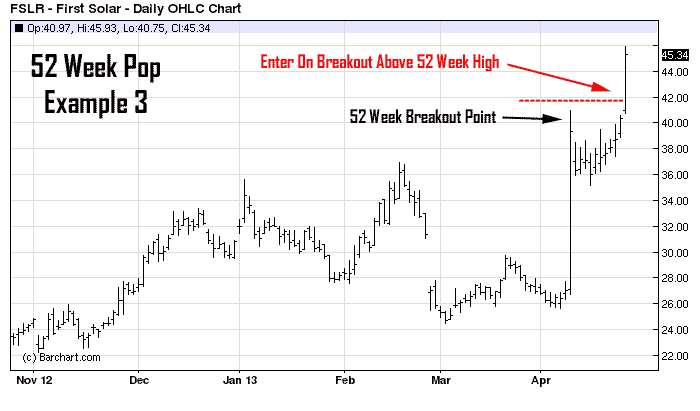

In the example below, you’ll notice how First Solar Inc. (Nasdaq: FSLR) approaches the 52-week level like a magnet.

You should also make sure the stock or market you pick has sufficient volatility under normal trading conditions.

It probably goes without saying, but you should pick your tickers wisely when using the 52-week pop strategy.

Monitor the Market After a False Breakout

Once the stock you’re trading hits the 52-week high/low level, you should see an instant pullback away from that price range.

The stock should then take anywhere from one to three weeks to consolidate, and then try to break through the 52-week price high/low level for a second time.

In the example below, FSLR quickly pulls back and consolidates for about two weeks before trying to reach for the 52-week high level once again.

Monitor Entry Levels

As you monitor the market daily, you should keep track of the high of the day the stock initially made its 52-week high/low price on.

Your job will be to enter an entry stop order each day that’s $0.25 above that initial 52-week high/low price.

But you’ll only want to enter the order during the first hour of the trading day.

That’s because potential breakouts that follow tend to occur near the opening bell, and they’re extremely powerful.

I rarely see breakouts occur later in the day with sufficient momentum to make the trade worthwhile. If you’re not filled during the first hour, you should cancel your order ASAP.

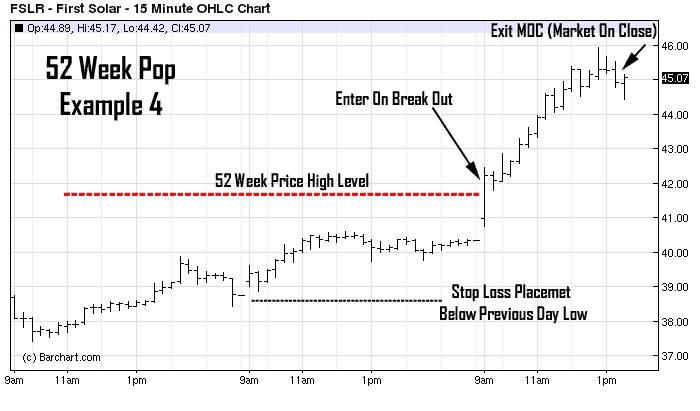

You can see in the example below how FSLR gaps up and doesn’t turn back down…

The volatility level should be similar to what you saw during the first time the breakout occurred.

An Intraday View of the 52-Week Pop Strategy

In the example below, you can see the entire trade progression from beginning to end.

The entry occurs $0.25 higher than the 52-week price high. In this case, the gap occurred at the opening bell, and we were filled substantially higher than $0.25.

This isn’t something to be too concerned with because momentum that usually comes from gaps near the 52-week high levels tends to follow through like in this example.

Once you’re filled, you need to place your stop-loss order below the low made the day prior to your entry.

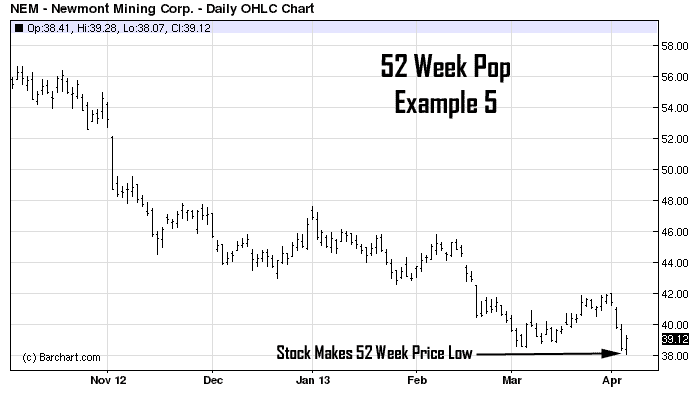

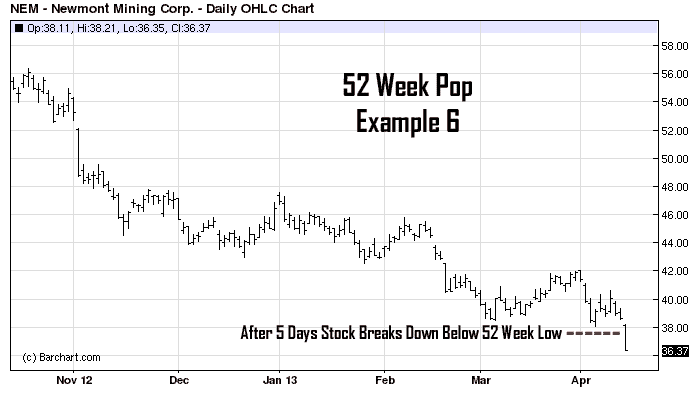

52-Week Low Example

In this example, you can see how the stock makes the initial 52-week low…

This is when we begin monitoring the stock for the next one to three weeks to see if it pulls back and tries to break through the 52-week low level again.

I suggest you trade to the downside just as often as you trade to the upside.

Momentum is typically stronger and quicker to the downside as opposed to the upside most of the time.

In this example, the stock only pulled back for six days…

The pullback is also usually quicker to the downside.

Notice how the breakdown below the 52-week low was volatile and once again started with a small gap…

The gap isn’t a necessity, but you will see it often when trading the 52-week pop strategy.

The second breakout below the 52-week low tends to carry strong momentum.

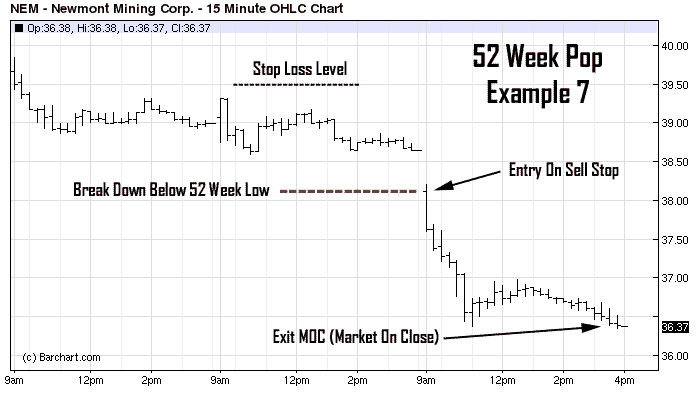

The Entire Sequence Intraday Chart

You can see the entire sequence of the trade to the downside.

In this example, I used two different stocks. But the 52-week pop strategy works just as well with commodities, futures and currencies.

I’ve been trading this strategy with consistent results using precious metals and currencies for over a decade.

Things to Keep in Mind

When trading the 52-week pop strategy, you should use 15-minute bar charts the day you intend to enter a position.

I always use the daily chart to isolate the pattern and make sure it’s setting up correctly. Once the setup is correct and my order is entered, I switch to the shorter time frame to make sure the pattern is developing accordingly.

My stop loss is placed a few cents below the low prior to your entry day breakout.

The stock you’re trading should never go back to this level if the trade is working out as planned. But also keep in mind that you should never enter the trade after the first hour of the day.

The 52-week pop strategy thrives on momentum. So if the market doesn’t start out that way in the morning, odds are it won’t begin during the trading day.

Lastly, make sure you keep the trade open till the end of the day to give yourself the highest odds of achieving maximum profit potential.

I hope that helps!

Roger Scott

Roger Scott Trading

P.S. Coming MONDAY: My Pre-Election Forecast!

One thing I don’t talk about around here is politics, especially when it comes to my personal opinions.

We’re all here to talk about the market and make money, and that’s the bottom line.

But when it comes to our portfolios, the winner of the 2024 election will have a big impact on how and what we trade.

This could be one of the biggest elections in history in that regard, so I’m tapping into a rare phenomenon to prepare and take advantage of incoming volatility.

And I’m hosting a major event at 1 p.m. Eastern on Monday, where I’ll show everyone how I’m preparing and planning to trade that volatility.

I’ll also give away my No. 1 election stock, and the sector I expect to outperform in the lead up to the big election.

There are BIG opportunities ahead, so be sure to hit that link below…