LIVE AT 11:15 AM ET: THIS MORNING’S TOP PENNY OPTIONS WITH LANCE IPPOLITO!

As we approach the end of the year, the market is showing a clear divide between sectors that are thriving and those that are struggling. With fund managers mostly allocated and focused on protecting their positions, the opportunities for traders lie in carefully navigating these trends.

The Consumer Discretionary sector (XLY) has been on a tear, up about 25% the past three months. Retail stocks, in particular, have shown strong performance, with earnings from Lululemon (LULU) providing another boost late last week. LULU is now up 60% over that same three-month stretch.

The strength of the U.S. dollar — allowing consumers to spend more — has bolstered this area.

Likewise, the Nasdaq 100 (QQQ), driven by the Magnificent 7 stocks, continues to lead the charge. Communication Services (XLC) is also riding high, up almost 20% the past three months, offering additional long opportunities for traders looking to align with the market’s current leaders.

However, not all sectors are enjoying this upward momentum…

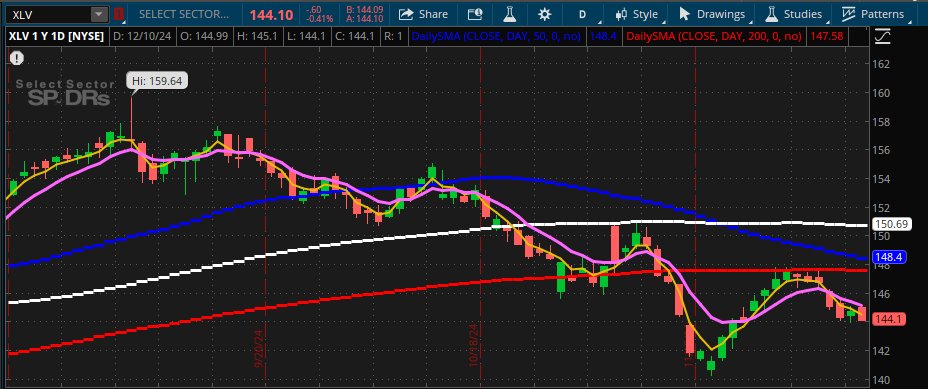

Health Care (XLV) is breaking through key support levels, signaling potential weakness ahead. It looks primed to retest its lows, making it a compelling target for shorts.

Similarly, Basic Materials (XLB) is underperforming — not outright bearish yet, flat over the past three months, but certainly not showing the strength needed to attract bullish interest.

Small caps, as represented by the Russell 2000 (IWM), have been stagnant over the past month.

Despite sitting near highs, IWM has been chopping sideways for weeks, unlike the consistent upward trends seen in the S&P 500 and Nasdaq, though the Nasdaq has also taken a dip of late.

With portfolio managers prioritizing large-cap growth stocks to secure year-end performance gains, small caps have been left out of the rotation so far.

The key takeaway here is balance…

Long positions in thriving sectors like Consumer Discretionary, Communication Services and Tech can be complemented by short plays in struggling areas like Health Care and Basic Materials.

This dual approach not only captures the market’s current dynamics, but also hedges against any unexpected shifts in sentiment or volatility.

Looking ahead, keep an eye on sector rotation and capital flows.

With volume likely to remain muted until January, the opportunities will favor strategic, sector-specific plays. By focusing on the winners and losers, you can stay ahead of the curve and close out the year on a strong note.

Kane Shieh

Kane Shieh Trading

Follow along and join the conversation for real-time analysis, trade ideas, market insights and more!

- Telegram: https://t.me/+Ji2OakXnGMM5OTI5

- YouTube: https://www.youtube.com/@GammaPockets/featured

Important Note: No one from The TradingPub team or Kane Shieh Trading will ever contact you directly on Telegram.

*This is for informational and educational purposes only. There is inherent risk in trading, so trade at your own risk.

P.S. How to ‘Front Run’ Wall Street’s Next Move

Thanks to a hidden force that drives some of the BIGGEST and most repetitive moves in stocks…

The average trader can now target 100% in five days or less without spending hours on technical analysis…

Without reading boring fundamental reports…

And without monitoring the markets 24/7.

I call this hidden force a “Gamma Pocket.”

And it’s the reason why you and I can now front run some of Wall Street’s largest buy orders on certain stocks…

Including AAPL, NKE, CAT, AMZN and More!

Disclaimer: The profits and performance are not typical, we make no future earnings claims, and you may lose money. From 1/1/24-11/25/24 we have seen a 78% win rate on LIVE trades with a 49% average return for winners and losers, and a 77% average winner over a 5 day average hold time.