Learn how to target north of $1K per trade by “hijacking” the options chain — LIVE at 1 p.m. ET on Wednesday with Nate Tucci!

If you’ve been following along for any length of time, then you likely know that options trading is my bread and butter…

And I do it by tracking and trading the unusual options activity that peppers my News Flow Scanner all day long. And trading this earnings season has been nothing short of incredible.

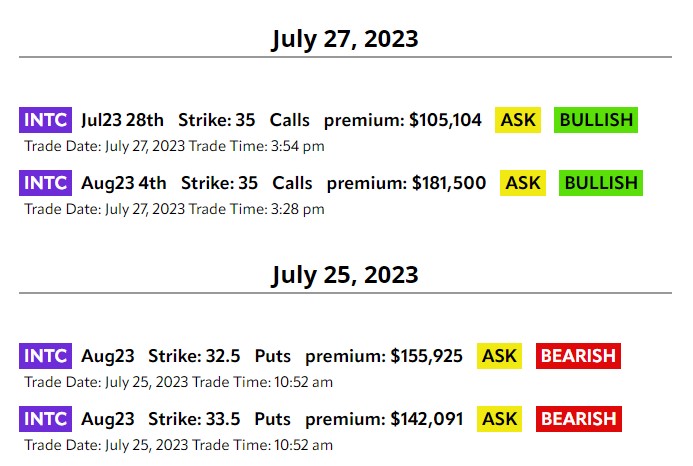

If you’ve attended any of my live trading sessions and watched the chat, then you’ve probably seen a lot of people asking how I differentiate the good orders from the bad, especially when we see conflicting orders like this come in just two days apart…

Intel reported earnings Thursday after the close, so all four of these, especially the short-dated calls that came the last 30 minutes that day, are clearly earnings plays.

So how would I know which is worth considering, calls or puts?

It’s pretty simple, actually…

When you see conflicting orders the same day or just a day or two apart, you have to consider what kind of stock it is, and its normal trading volume.

Intel is a widely traded stock in both shares and options. So you’re going to see names like this, Tesla, Apple, Amazon, Microsoft, Google — all the big dogs — trade millions of shares/contracts a day.

So when you see an order in INTC for $100,000 or $150,000… that’s not a particularly big order for a big stock.

The next thing I look at is the chart… Using INTC still, this is a bullish chart dating all the way back to October 2022.

This stock was also trading around $34.50 or so when the $32.50 put came in, so that’s out of the money (and cheaper)…

So to me, the bullish long-term daily chart along with it being a smallish total bet for such a widely traded stock, this tells me it’s likely a hedge against a long stock position in case earnings are bad.

Think about it like this…

Most institutions and hedge funds are long in their stock positions, especially ahead of catalysts like earnings events. So they buy out-of-the-money (OTM) puts as insurance in case the stock tanks.

Back to INTC and the calls… they were the $35 strike. So, obviously, they’re pretty much in the money (ITM) — that tells me it’s a higher-probability play.

So I always favor calls over puts when they hit the scanner.

But my ears do perk up when it’s a big premium paid for ITM puts.

And always be aware of upcoming catalysts like earnings. If it’s an OTM put on a stock with a bullish chart, it’s likely a hedge.

I hope that helps!

Lance Ippolito

Lance Ippolito Trading

The Day’s Top Flow, May 28, 2024:

Please note, these companies are reporting earnings this week, and each of these trades can and will go against you in a hurry if wrong, especially the two short-dated plays. As always, respect that risk and don’t blow up your account! Paper trading is a great way to learn while still keeping your account intact.

- CAVA Jun24 7th Strike: 84 Calls premium: $412,311 ABOVE ASK BULLISH

Trade Date: May 28, 2024 Trade Time: 10:51 am - ANF Jul24 Strike: 155 Calls premium: $241,670 ASK BULLISH

Trade Date: May 28, 2024 Trade Time: 11:30 am - CRM May24 31st Strike: 280 Calls premium: $108,000 ASK BULLISH

Trade Date: May 28, 2024 Trade Time: 10:36 am

P.S. Traders Have No Idea They Could Be Doing This…

An upcoming government meeting could shake up the markets over the next two weeks.

And options expert Nate “The Income Kid” Tucci believes it’s setting up an opportunity for you to pull in SAFER profits by “hijacking” options targeting $1,250 with each $2,500 starting stake.

He’ll show you how to do just that starting at 1 p.m. ET on Wednesday!

You’ll see that you don’t need to stare at charts… And you really don’t need to click ANY extra buttons.

You just need to deploy a certain type of trade before the end of the week…

And once the trade is activated, you can sit back and let it do its work… AUTOMATICALLY.

If you ask me, the timing for this is perfect.

Although we can’t guarantee results or against losses…

Join Nate this Wednesday where he’ll share the details of this special trade with you LIVE.

Disclaimer: The profits and performance shown are not typical, we make no future earnings claims, and you may lose money. The trades expressed are from historical data in order to demonstrate the potential of the system. Based on the backtested data between 1/3/20 and 4/22/24 the average winner has been 49.07% with the average return of winners and losers at 14.67% and an incredible 76.9% accuracy rate on a 10 day average hold time.